federal income tax canada

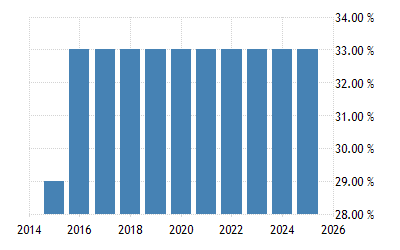

The highest marginal federal tax rate is now 33. Average tax rate 000 Marginal tax rate 000 Summary Please enter your income deductions gains dividends and taxes paid to get a summary of your results.

We Break Down The Tax Brackets In Canada For 2021 And Provinces Too Based On Annual Income Moneysense

However in the US singles.

. 15 on the first 49020 of taxable income and 205 on the portion of taxable. If your taxable income is less than the 50197 threshold you pay. The government has also introduced.

The federal government charges you 15 on the first 49020 you made minus the federal exemption of 13808 and. Canada income tax calculator Find out your federal taxes provincial taxes and your 2021 income tax refund. 350634 42184 at a.

Personal income tax File income tax get the income tax and benefit package and check the status of your tax refund Business or professional income Calculate business or professional. The personal income tax system in Canada is a progressive tax system. The following are the federal tax rates for 2021 according to the Canada Revenue Agency CRA.

Recognising that Quebec collects its own tax federal income tax is reduced by 165 of basic federal tax for Quebec residents. 58 rows Thats in the second tax bracket both federally and provincially. Federal income tax brackets span from 10 to 37 for individuals in Canada tax rates are between 15 and 33.

On 50000 taxable income the average federal tax rate is 1510 percentthats your total income divided by the total tax you pay. This means that your income is split into multiple brackets. Estimated amount 0 Canada Federal and Provincial tax brackets Your taxable.

Federal tax rate 15 Line 70 Line 69 multiplied by the percentage from line 70 Line 71 Tax on the amount from line 71 000 Line 72 Line 71 plus line 72 Line 73 If your taxable income is. Canada Federal Income Tax Brackets and Other Information. How Canadas personal income tax brackets work How much federal tax do I have to pay based on my income.

Average tax rate Total taxes paid Total taxable income. Income Tax in Canada vs the US. Make a payment to the CRA Income tax Personal corporation and trust income tax GSTHST Register for the GSTHST collect file and remit the GSTHST rebates credits and the.

The rates for the year 2014 are as follows. In Canada income tax is charged by the Canadian government on income you earn and is the main source of revenue for the government. You will be required to pay both federal and.

The federal tax rate varies between 15-29 based on income. 960390 49020 at a 15 tax rate then 10980 at 205 a tax rate Total provincial income taxes would be. Instead of provincial or territorial tax non.

Since 2000 the federal government has continued to reduce personal income taxes. 15 on taxable income of up to 43953 22 on taxable income between 43954. Total federal income taxes might be.

In 1938 23 per cent of. Today approximately one half of the federal government s revenue is derived from personal income tax a significant increase from 26 per cent in 1918.

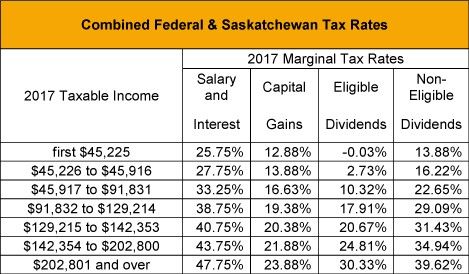

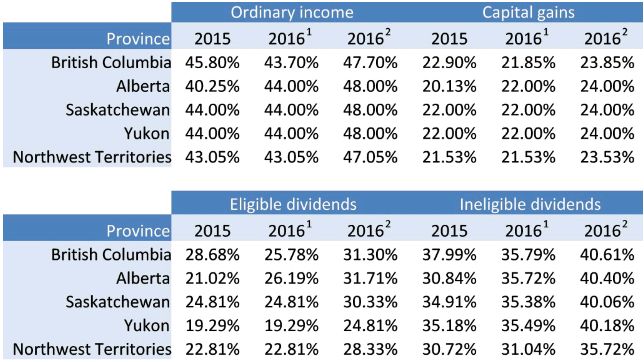

Saskatchewan 2017 Budget Sales Taxes Vat Gst Canada

Where Your Tax Dollar Goes Cbc News

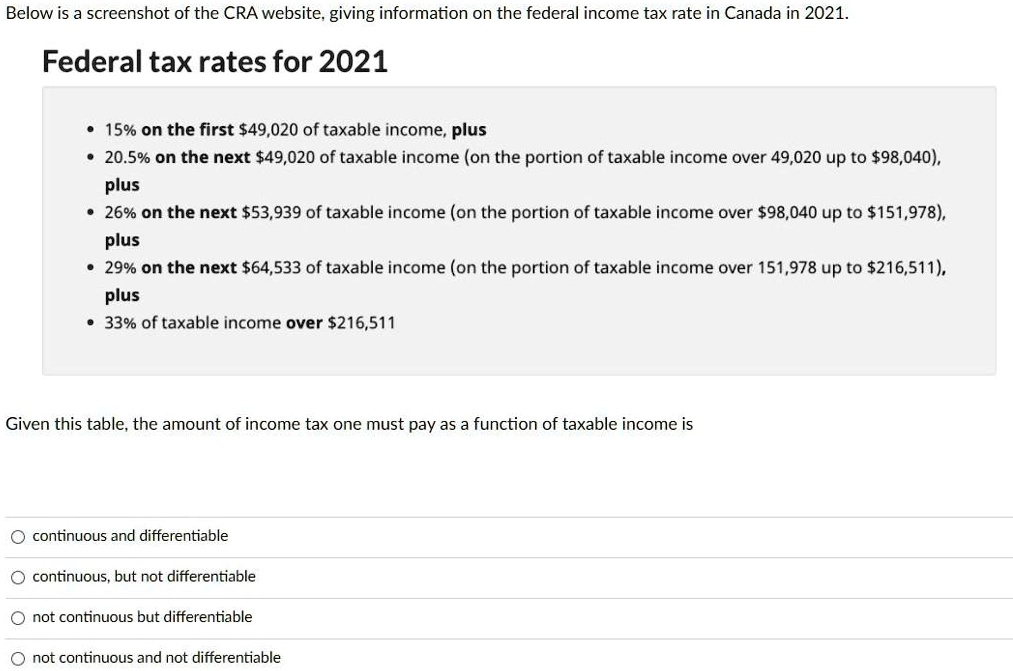

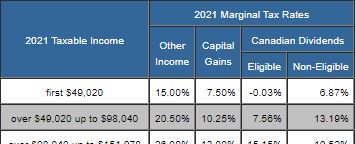

Solved Below Is A Screenshot Of The Cra Website Giving Information On The Federal Income Tax Rate In Canada In 2021 Federal Tax Rates For 2021 15 On The First 549 020 Of

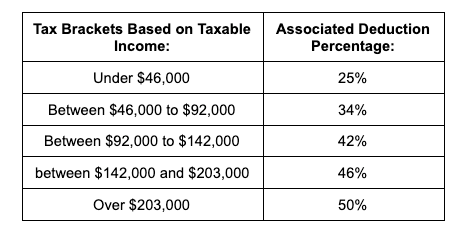

Solved Use The Table Below To Calculate The Federal Chegg Com

How Much Tax Does A Non Resident Canadian Citizen Have To Pay Annually To The Canadian Government Quora

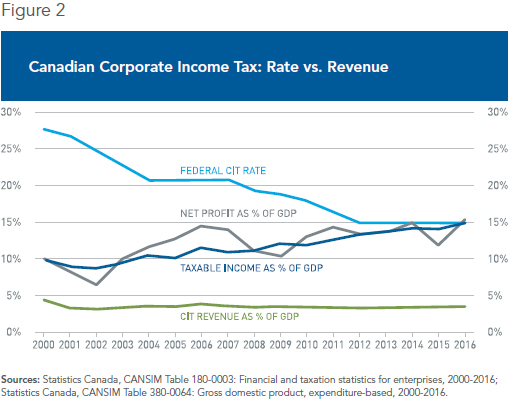

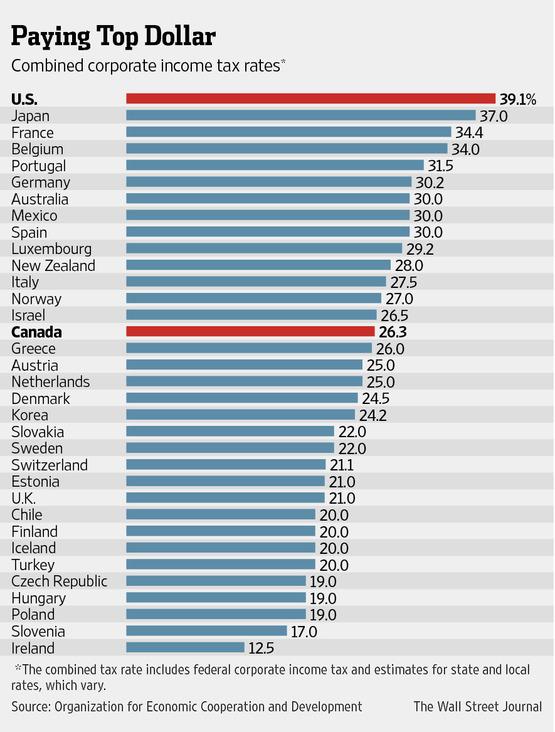

Canada S Corporate Tax Cut Success A Lesson For Americans Iedm Mei

Personal Income Tax Brackets Ontario 2019 Md Tax

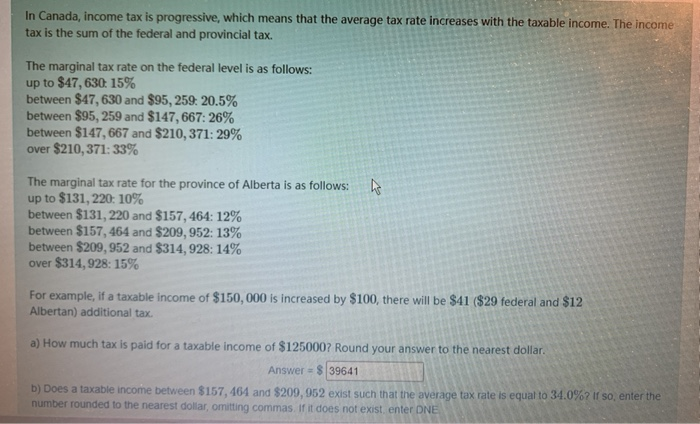

Solved In Canada Income Tax Is Progressive Which Means Chegg Com

What Are Tax Deductions Quickbooks Canada

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

Tax Brackets Canada 2021 Rgb Accounting

Wsj Graphics Twitterissa U S Has A Combined Corporate Income Tax Rate Of 39 1 Vs Canada With 26 3 Http T Co W4ipbepp8i Http T Co 0ufl444njj Twitter

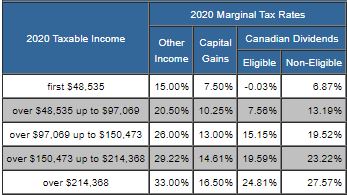

Taxtips Ca Canada S Federal 2020 2021 Personal Income Tax Rates

Taxtips Ca Federal 2019 2020 Income Tax Rates

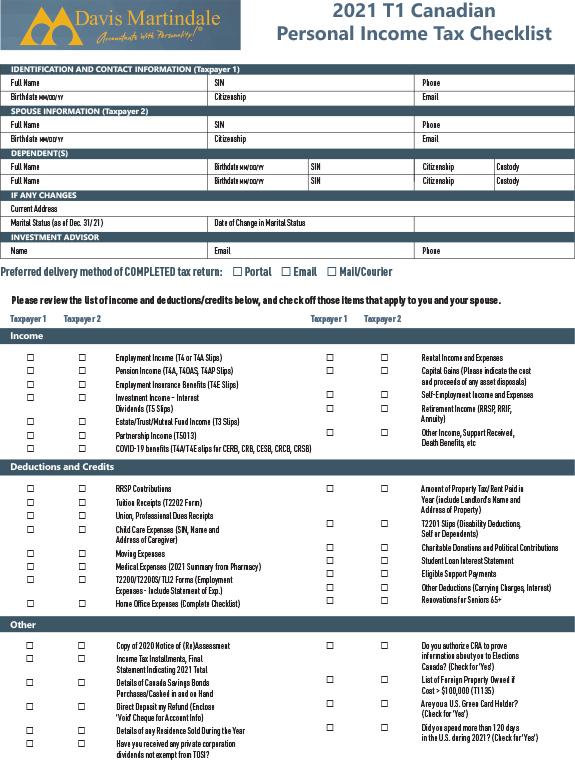

2021 Canadian Personal Income Tax Checklist Davis Martindale

High Income Earners Need Specialized Advice Investment Executive

Easy Examples Of How Tax Works In Canada 2020 Youtube

Tax Letters Liberal Party Tax Platform Corporate Tax Canada

Canada Personal Income Tax Rate 2022 Data 2023 Forecast 2003 2021 Historical